Breakdown cover maths

So, I'm getting rather fed up with the AA taking the michael every year with their renewals. Yes, I gather the RAC are just as bad but I think they need to realise their customers aren't stupid, know exactly what they are playing at, and can do the maths.

I want to highlight what I think is a particularly dirty trick, making something look like a free perk when it's anything but.

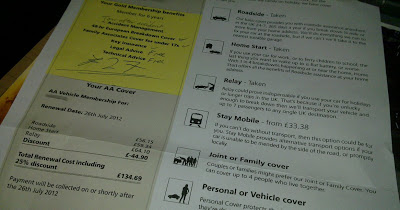

So here's some numbers:

This is for a single car policy covering Roadside, Home Start and Relay starting July 2012 paying annually for a year up front. (The monthly option is 10% more expensive, go figure). Numbers rounded to pounds.

- Renewal through the post: £135

- Matching RAC cover(checked online & by phone): £101

- AA online price for new customers: £92 -(so much for 6 years loyalty, a £43 kick in the teeth)

- AA phone price: £116

- AA phone price without gold membership "benefits": £89

That means, the AA are pricing their gold benefits at £27 even though they look like they are free on the renewal letter! Some cheek.

I queried the details of this so called benefit and established the following:

- "Accident Management" - means being towed by the AA after an accident (something you may be covered for under your car insurance policy)

- European Breakdown Cover - only useful if you are going abroad (obviously), did you really want to be paying for it?

- "Family Associates Cover for under 17s" - something about teenagers, I don't have any so not very useful to me

- Key Insurance - this could be valuable, but £27/year sounds like very expensive insurance to me even though they are expensive items to replace.

- Legal Advice - Included as standard! So not a gold benefit at all. Weasels.

- Technical Advice - Included as standard! See above. Still weasels.

So it turns out that the supposed discount of £44.90 on the posted renewal was actually a £46 insult to my intelligence.

I'm no money saving expert, but that's outrageous.